Grocery Shop 2024: New Grocery Technology Appears In Store and Promises to Change the Shopping Experience

The GroceryShop conference in Las Vegas last month delivered success once again. This year’s show brought to life concepts that seemed like distant visions last year—ideas like in-store media networks and smart shopping carts equipped with ad capabilities. Retailers once questioned the feasibility of such innovations, but this year, we saw fully operational versions already integrated into stores and actively engaged by shoppers.

The Profitability Puzzle of E-commerce

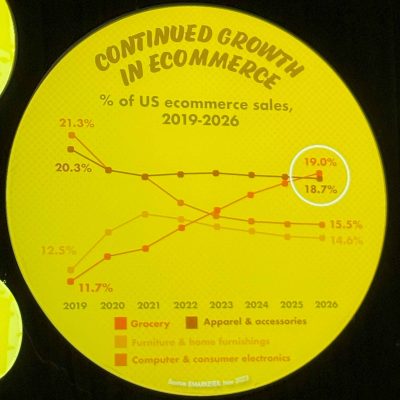

Retailers have embraced e-commerce, yet its profitability remains elusive—if anything, it erodes their margins. As e-commerce continues to expand, it compresses overall profit margins and puts unrelenting pressure on the bottom line. Retailers are pursuing new strategies to boost profitability, exploring ways to reduce fulfillment costs or add new revenue streams to these digital transactions. Some are examining ways to trim expenses, enhancing transaction efficiency and profitability. Others are identifying additional income avenues, such as retail media, that align with these e-commerce channels. Grocery e-commerce is evolving rapidly, and what we see today is likely just a preview of its future state.

Digital Dominance Requires Ownership

The retailers making headway are those that own the entire digital journey—transaction, delivery, and every retail media interaction in between—retaining a consistent customer relationship from start to finish. This approach demands a substantial investment, and many retailers have been tempted to outsource various aspects. However, a plug-and-play approach rarely delivers a competitive advantage. Ultimately, grocery retailers will need to bring these operations in-house, personalizing them to create a distinct experience that can set them apart in the market.

Reimagining the Role of Grocery Stores

As online transactions rise, the need for large, traditional grocery stores serving retail customers diminishes. Many chains are rethinking how to repurpose these spaces in novel ways. Lowe’s Foods on the East Coast exemplifies this, with forward-thinking strategies that transform stores into hubs of brand activations, in-store events like dances, and various entertainment experiences. While I’m not within driving distance, I’d love to visit one of these locations. This innovative approach contrasts with some chains that continue to see their stores as unchanging community anchors—a perspective that feels like a throwback to 1995. The real question is whether communities still view these stores as vital and will keep shopping in them in the future. It will also be fascinating to watch how chains preserve their brand identity and team connection, especially as some outsource their e-commerce operations to third-party delivery providers, leaving consumers to interact with those companies’ employees instead of the grocer’s own.

Retail Media Moves In-Store

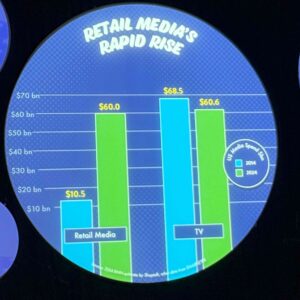

Retail media is making a notable transition in-store, with virtually every inch of the environment now an opportunity for brand engagement. At an 80%+ margin, retail media is very attractive to Retailers and many are exploring any opportunity to expand placements. This year, Brands will spend more on retail media than TV for the first time. Brands showcased new LED technologies that bring animated visuals to endcaps, shelf strips, and other store areas, captivating attention, sharing brand stories, and enhancing customer engagement. The effect is immersive; aisles are wrapped in a stadium-like ambiance, with graphics creating a seamless, branded experience. As retailers embrace these technologies and sell these in-store activations, the shopping experience will transform from a simple aisle stroll to a vibrant, interactive encounter with brands paying for premium shelf space.

In this changing landscape, Instacart has positioned itself exceptionally well. From digital shelf tags to fully integrated shopping carts and in-store activation platforms, Instacart offers a comprehensive suite that connects with the consumer at every purchase stage. Early tests reveal technology that is consumer-friendly and value-adding, making in-store navigation easier while offering savings. These consumer benefits should drive quicker adoption compared to other tech initiatives.At

A New Era for In-Store Innovation

For over a decade, the industry’s focus has been on enhancing the online and digital experience. But now, as consumer expectations evolve, that same innovation is coming to the in-store environment. Consumers will soon recognize which retailers embrace this digital shift and which feel dated. With so many changes on the horizon, the grocery retail marketplace is set for transformation, ultimately enriching the shopping experience for consumers.

Engaging Discussions Enable Confident Decisions®

When you’re busy with the daily demands of your job, it’s easy to overlook the opportunities that will drive long-term growth. When you become a member of a Drive Wheel peer group, you can identify new strategies, reduce risk, and make confident decisions that will grow your business faster and more strategically.

We host two-day in-person meetings twice a year where leaders discuss their new strategies, innovation plans, and business challenges to get feedback from their peers. Members leave the meeting knowing they have thought about their idea from every angle. Between meetings, we conduct benchmarking studies and weekly news roundups to keep our members informed about changes in the industry.